Amelkis EPM Business Plan the financial planning software synonymous with excellence

The application that meets the operational challenges of the finance department.

Zoom on the key features

The financial planning software Amelkis allows financial departments to go further in the realization of their forecasts. It transforms the business plan into a real tool for decision-making and management of the activity.

Why choosing EPM Business Plan?

EPM Business Plan meets the operational needs of companies operating in demanding environments.

A solution that meets the operational challenges of finance departments

The EPM Business Plan financial planning software focuses on performance measurement and the quasi-automatic adjustment of development assumptions.

It provides finance departments with the tools to master an often complex environment (subsidiaries spread around the world, currency issues, multiple intra-group operations, volatile business sectors, etc.).

Automate the development process

Simplify the updating of the business plan

Empower users

Easily justify calculations

Connect the forecast to actual performance

Structuring features

Through its 12 functionalities, the EPM Business Plan financial planning software offers the best practices in forecasting to provide financial departments with an incomparable capacity for analysis and control. The business plan then becomes a real decision-making tool.

Constructing balance sheet trends with cash flow variables

Monitor the evolution of the group's overall profitability

Measure the evolution of certain balance sheet items by zooming in on them

Have a global and synthetic view of cash generation

Know the impact of changes in working capital requirements

Measure monthly variations in cash flow

Understand and justify changes

Automation of key operations

Amelkis EPM, and its financial planning module, is the result of several years of R&D, to achieve a software powerful and intelligent enough to support the financial departments. Automation is an integral part of the solution to facilitate the operations of consolidation, reporting and forecasting.

Collection of budget data

Calculation of the landing and balance sheet flows

Production of operating accounts

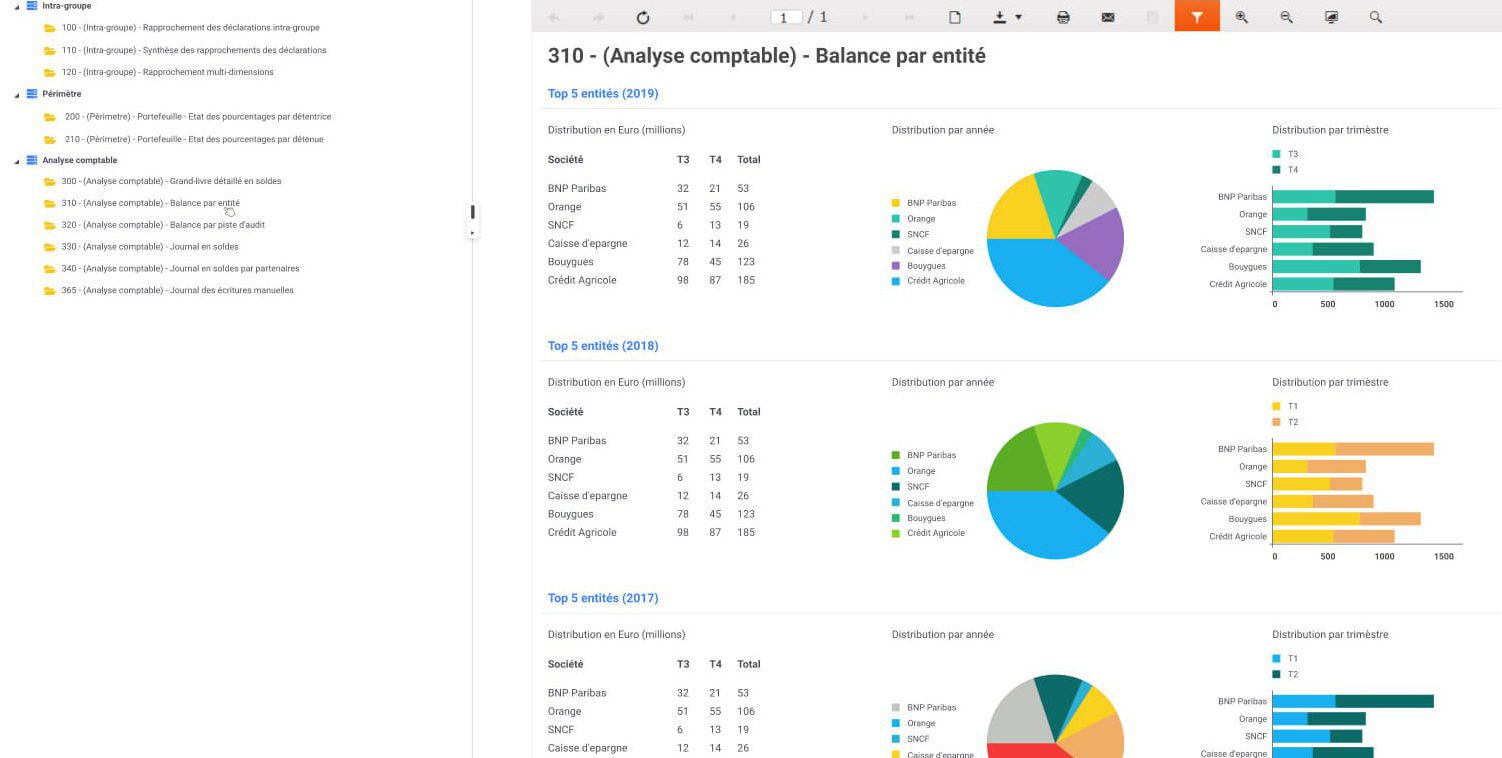

Generation of analysis reports by entity

Restatements

Cancellation of intra-group re-invoicing

Conversion of subsidiaries in foreign currencies with a calculation of the corresponding cash impacts

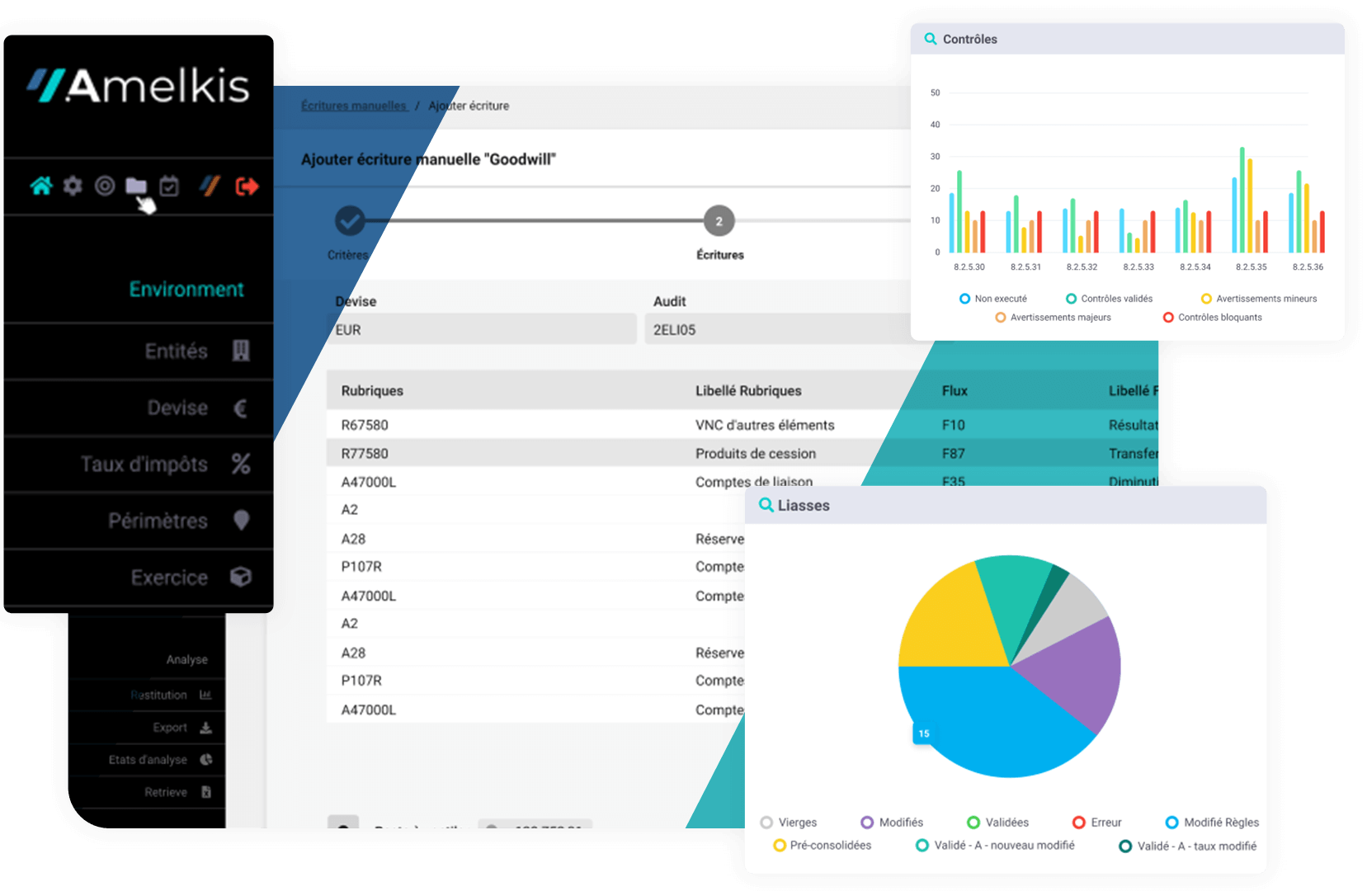

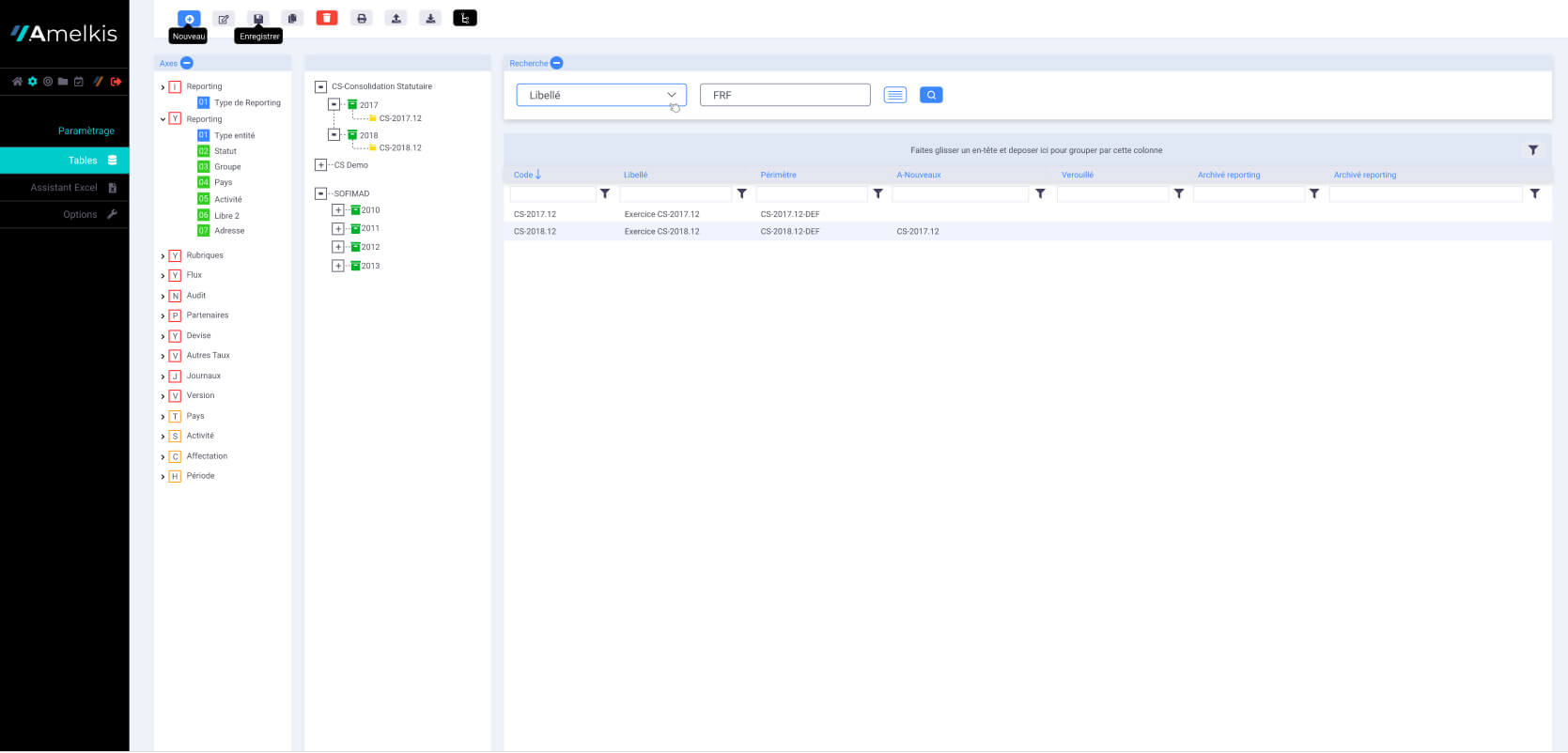

A design and ergonomic interface

EPM Business Plan offers fluid navigation and uncompromising ease of use, which will delight financial experts in search of efficiency and modernity.

Enter in the Amelkis universe

Amelkis draws a future without borders through a centralized management of all financial reporting. The consolidation, management reporting, forecasting and extra-financial finally evolve on a single interface, fluid and intelligent.

They trust us

Amelkis is a powerful, flexible and intuitive software. It makes consolidation accessible to all finance professionals.

Yann Volluz, Administrative and Financial Director at Logteam

When we import the accounting data into Opera, the solution automatically integrates the bundles in the right place. The integration of the consolidation data takes two days, compared to two weeks before !

Luc Nivinou, Head of management control and financing at LE SAINT group

We save time when distributing income statements: everything is very easy to export with Opera*. Especially since the solution is compatible with the Office environment. This time saving is not negligible, when you know that we ensure the consolidation of more than 200 companies, which is done for 80% of them at the end of the year. The period is more than busy: a powerful tool is essential ! (* Opera is the previous version of Amelkis EPM)

Christian Potiron, Head of consolidation at La Fidu Group

We have saved about 30 minutes of reprocessing time per tax return. We now spend only one hour per company to identify anomalies and check revisions, compared to an hour and a half previously.

Christian Potiron, Head of consolidation at La Fidu Group

We found a real closeness with the editor: they answer our needs and questions with professionalism and precision.

Christian Potiron, Head of consolidation at La Fidu Group

Amelkis Opera* allows us to make reports and forecasts more fluid and efficient. The tool has been configured according to our needs to generate consolidated plates easily usable. (* Opera is the previous version of Amelkis EPM)

Béatrice de Foucauld, Administrative and Financial Director at SAFO Group

We hooked up with Amelkis from the first exchanges. The solution Amelkis Opera * met our expectations in terms of simplicity and accessibility for non-specialists in the consolidation. The interface has immediately seduced us: we did not feel to make the consolidation so ergonomic tool. (* Opera is the previous version of Amelkis EPM)

Luc Nivinou, Head of management control and financing at the LE SAINT group

We have a single solution to manage a large part of our financial activity. We have access, via the same interface, to the group's consolidated accounts, to the management of inter-company customer/supplier flows, as well as to the monitoring of the restatement of leasing. All the data is easily exploitable in the tool.

Anthony Jean, Associate Accounting Manager at SEAFRIGO Group

With Amelkis Opera, we follow the consolidation process, things happen according to a very logical scenario.

Laurent Auger, Public accountant, founding partner at the accounting firm FIPAR

Users have quickly adopted Amelkis Opera*, they saw a real interest, they were previously reporting on Excel. The data entry is secure, the operations are better managed, therefore more reliable. (* Opera is the previous version of Amelkis EPM)

Béatrice de Foucauld, Administrative and Financial Director at SAFO Group

Everything is easier with Opera [...] even for someone who is not a consolidation specialist! [...] The logic of use and the intuitiveness are unstoppable!

Luc Nivinou, Head of management control and financing at the LE SAINT group

Using this tool gives me more comfort about the accuracy of my consolidated statements and allows me to consolidate more quickly.

Xavier Rappaz, Financial Director at TELEVERBIER

We have made the consolidation process more secure: the tool facilitates the tracing of operations for auditing purposes, and we can generate complex reports - on sub-baskets, for example - which is important for certain groups. The tool also simplifies the export of consolidated budget forecasts.

Laurent Auger, Expert accountant, founding partner of the firm FIPAR

Amelkis Opera* is a very successful tool in terms of functionality that can integrate the reporting and forecasting. Amelkis Opera is also a very proven tool with many customer references in France. (* Opera is the previous version of Amelkis EPM)

Smarthys, Specialized consulting firm

We are delighted to support Amelkis clients in their ESG initiatives and the drafting of their first CSRD reports !

Sarah GUEREAU, Sustainable Development Offer Manager

Discover Amelkis EPM in live action

Make your forecasting statements real tools for performance management! Discover the power of Amelkis financial planning software during a quick demonstration.

Our assistance

You can count on Amelkis to accompany you in each of your challenges.

Contact us !

Enter the era of Enterprise Performance Management (EPM) with Amelkis !