Amelkis Lease the lease software essential for groups

For a simple and intuitive management of rental and leasing contracts

Zoom on the key features

Amelkis Lease guarantees the management and compliance of your leases subject to IFRS 16, IAS 17 and ASC 42

A simple tool to go further in the management of contracts

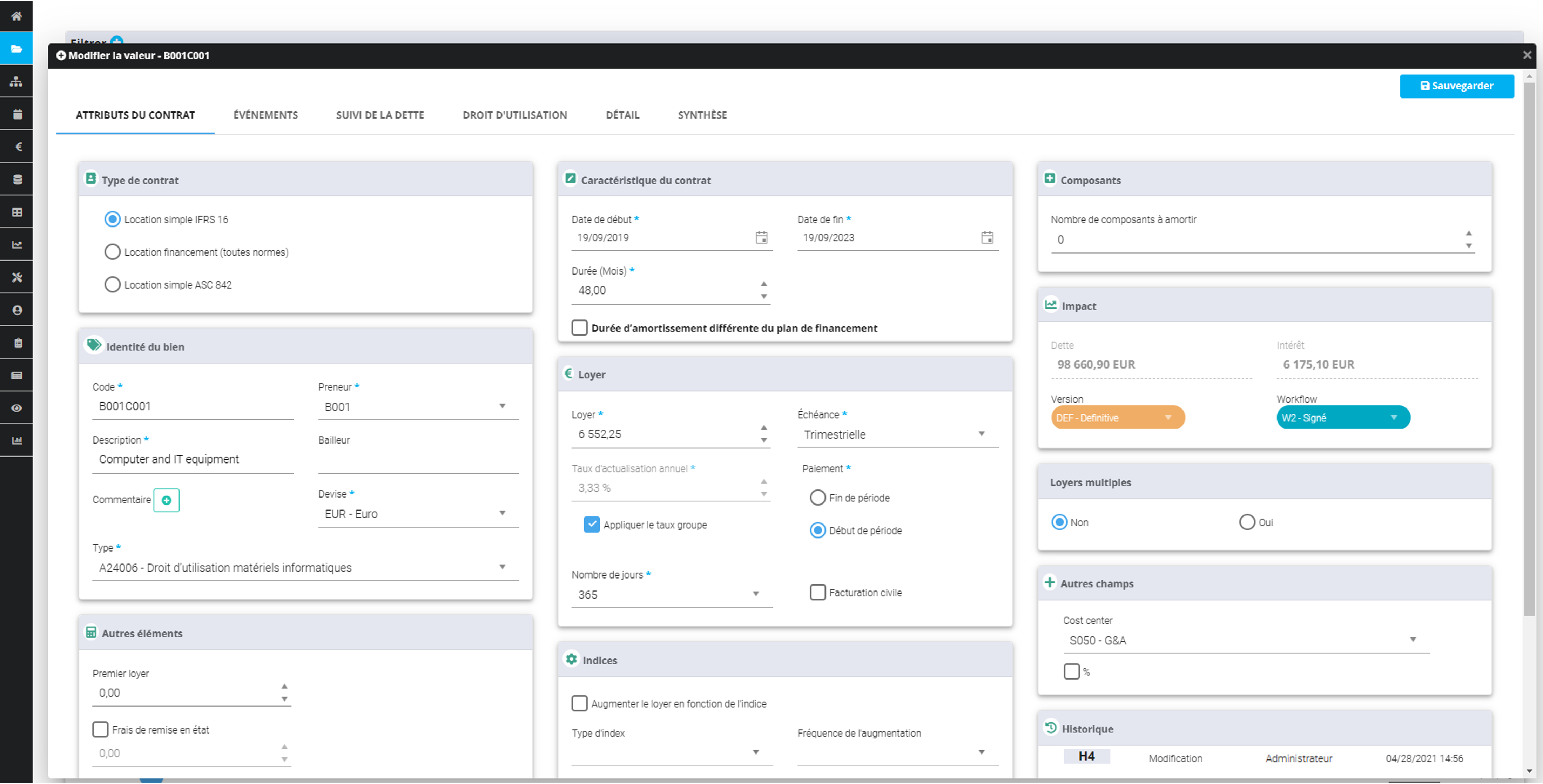

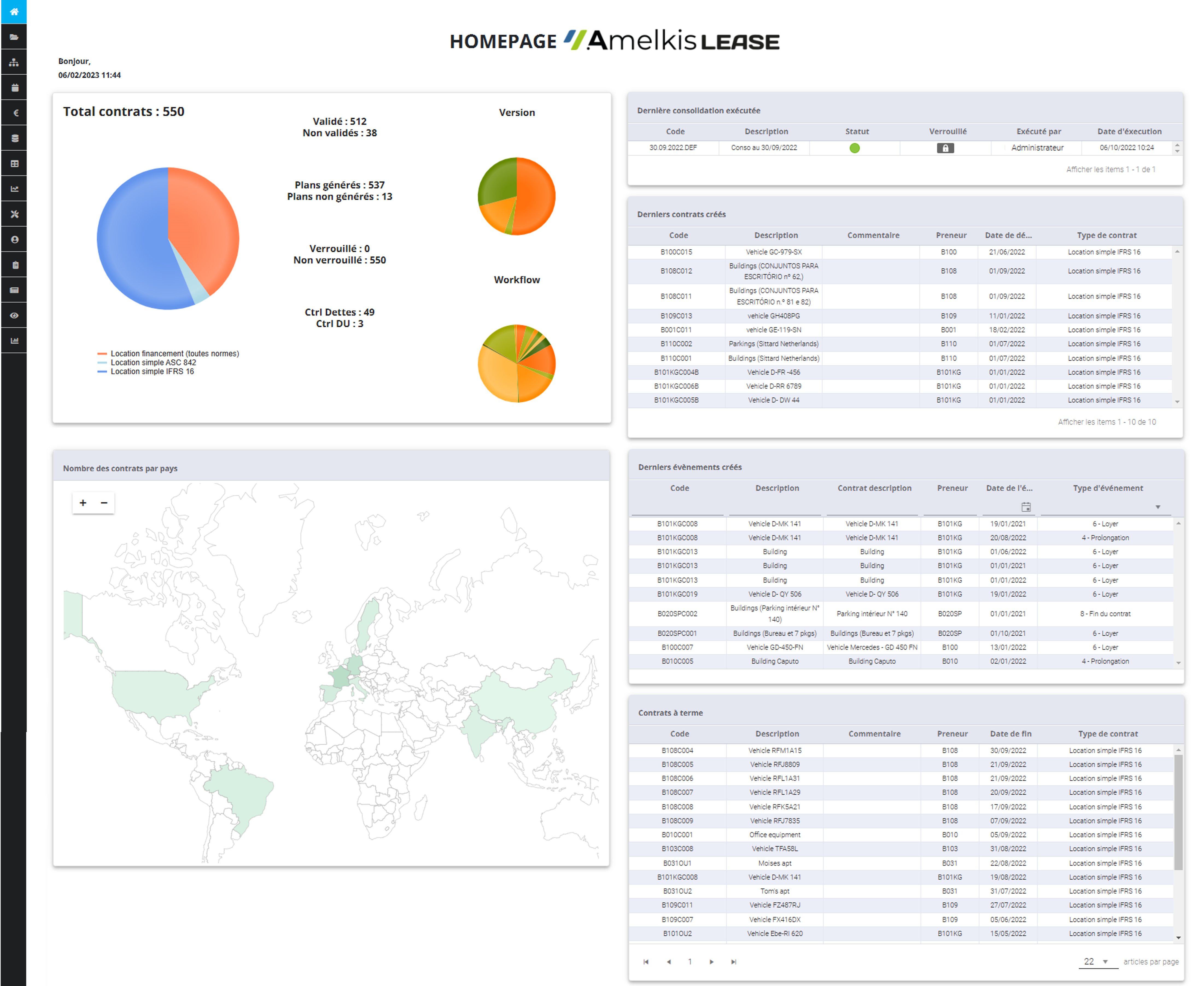

Operational in just a few days thanks to a complete configuration, Lease offers a simple and intuitive interface for 360° contract management.

The solution goes far beyond the centralization of information by supporting the business lines in their missions. Better still, it is capable of handling the most complex cases (deductibles with rent smoothing, depreciation by component, management of consolidation perimeters, multiple, evolving, variable rents, etc.)

Calculation of impacts by cut off, management of events and special cases

Complete audit trails and detailed exports by item or by flow

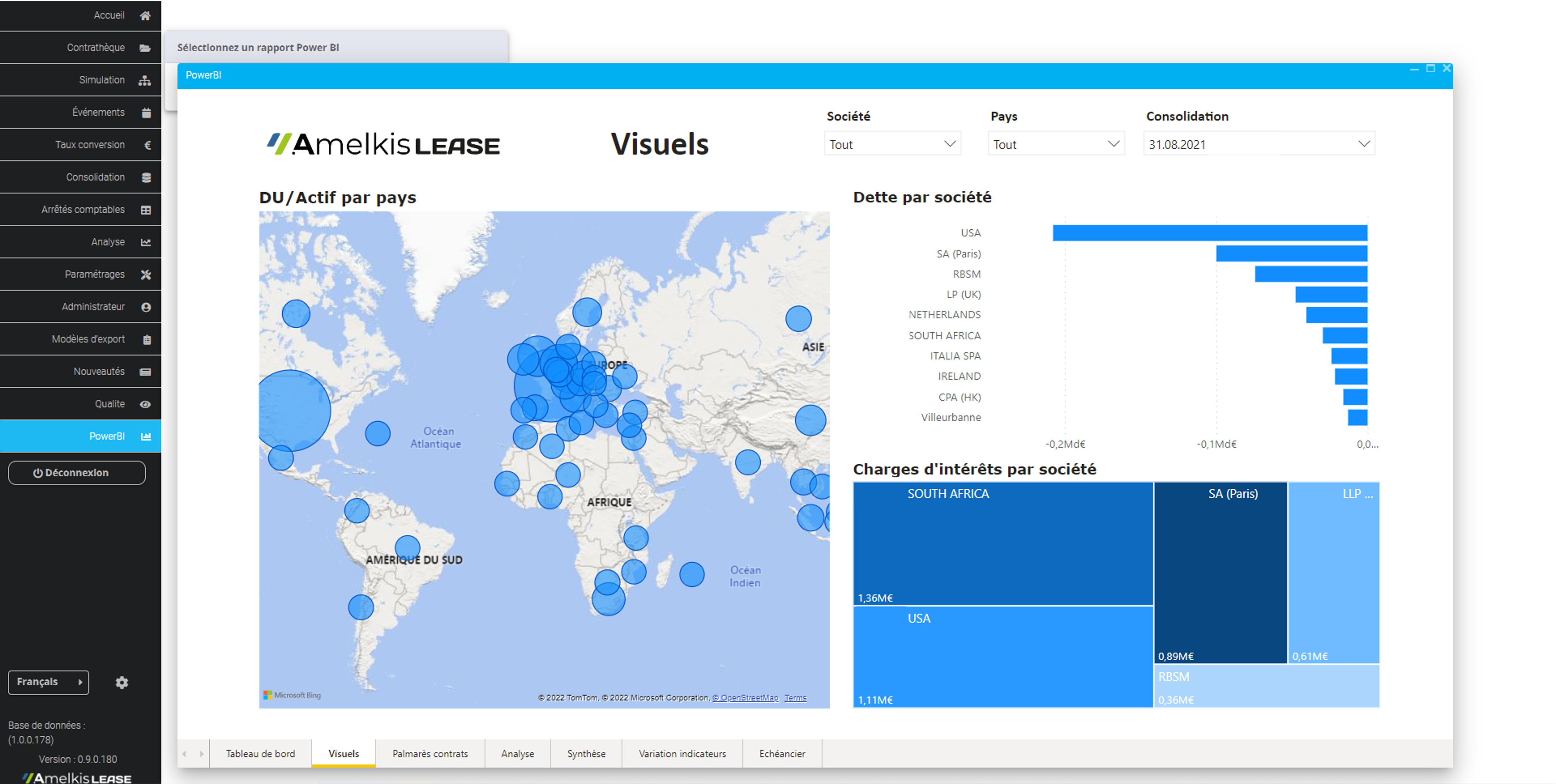

Powerful analysis tools: reports, graphs, cubes...

A solution that takes into account the needs of the business

Amelkis Lease is a Full Web application of the latest generation. The collaboration and sharing functions are easy and secure. They allow teams of all sizes to work together and get concrete benefits.

The finance function can analyze debt

Controllers can prepare budgets

Consolidators are able to apply regulation 2020.01, IFRS16 and IAS17

The support of a team of experts

Lease has a multilingual support team capable of assisting users in its use. The expertise, reactivity and skills of the support team are recognized by our customers.

Advanced customization capabilities

An IFRS 16 lease software has never been so quick to set up and customize! Indeed, the implementation of Lease is limited to a recovery of historical data and an initialization of the accounting framework according to the needs of each group.

A fluid and collaborative interface

Amelkis Lease offers a fluidity of navigation and simplicity of use without concession, which will delight financial experts in search of efficiency and modernity.

Enter in the Amelkis universe

Beyond the management of leases, Amelkis offers professional software for consolidation, management reporting, forecasting and extra-financial.

They trust us

We have a single solution to manage a large part of our financial activity. We have access, via the same interface, to the group's consolidated accounts, to the management of inter-company customer/supplier flows, as well as to the monitoring of the restatement of leasing. All the data is easily exploitable in the tool.

Anthony Jean, Associate Accounting Manager at SEAFRIGO Group

Amelkis Opera* allows us to make reports and forecasts more fluid and efficient. The tool has been configured according to our needs to generate consolidated plates easily usable. (* Opera is the previous version of Amelkis EPM)

Béatrice de Foucauld, Administrative and Financial Director at SAFO Group

Using this tool gives me more comfort about the accuracy of my consolidated statements and allows me to consolidate more quickly.

Xavier Rappaz, Financial Director at TELEVERBIER

When we import the accounting data into Opera, the solution automatically integrates the bundles in the right place. The integration of the consolidation data takes two days, compared to two weeks before !

Luc Nivinou, Head of management control and financing at LE SAINT group

Users have quickly adopted Amelkis Opera*, they saw a real interest, they were previously reporting on Excel. The data entry is secure, the operations are better managed, therefore more reliable. (* Opera is the previous version of Amelkis EPM)

Béatrice de Foucauld, Administrative and Financial Director at SAFO Group

We hooked up with Amelkis from the first exchanges. The solution Amelkis Opera * met our expectations in terms of simplicity and accessibility for non-specialists in the consolidation. The interface has immediately seduced us: we did not feel to make the consolidation so ergonomic tool. (* Opera is the previous version of Amelkis EPM)

Luc Nivinou, Head of management control and financing at the LE SAINT group

We have saved about 30 minutes of reprocessing time per tax return. We now spend only one hour per company to identify anomalies and check revisions, compared to an hour and a half previously.

Christian Potiron, Head of consolidation at La Fidu Group

With Amelkis Opera, we follow the consolidation process, things happen according to a very logical scenario.

Laurent Auger, Public accountant, founding partner at the accounting firm FIPAR

We found a real closeness with the editor: they answer our needs and questions with professionalism and precision.

Christian Potiron, Head of consolidation at La Fidu Group

Amelkis Opera* is a very successful tool in terms of functionality that can integrate the reporting and forecasting. Amelkis Opera is also a very proven tool with many customer references in France. (* Opera is the previous version of Amelkis EPM)

Smarthys, Specialized consulting firm

We are delighted to support Amelkis clients in their ESG initiatives and the drafting of their first CSRD reports !

Sarah GUEREAU, Sustainable Development Offer Manager

Everything is easier with Opera [...] even for someone who is not a consolidation specialist! [...] The logic of use and the intuitiveness are unstoppable!

Luc Nivinou, Head of management control and financing at the LE SAINT group

We have made the consolidation process more secure: the tool facilitates the tracing of operations for auditing purposes, and we can generate complex reports - on sub-baskets, for example - which is important for certain groups. The tool also simplifies the export of consolidated budget forecasts.

Laurent Auger, Expert accountant, founding partner of the firm FIPAR

Amelkis is a powerful, flexible and intuitive software. It makes consolidation accessible to all finance professionals.

Yann Volluz, Administrative and Financial Director at Logteam

We save time when distributing income statements: everything is very easy to export with Opera*. Especially since the solution is compatible with the Office environment. This time saving is not negligible, when you know that we ensure the consolidation of more than 200 companies, which is done for 80% of them at the end of the year. The period is more than busy: a powerful tool is essential ! (* Opera is the previous version of Amelkis EPM)

Christian Potiron, Head of consolidation at La Fidu Group

Discover Amelkis Lease in live

Improve your lease management now! See for yourself the performance of Lease, the most advanced IFRS 16 lease software on the market.

Our assistance

You can count on Amelkis to accompany you in each of your challenges.

Contact us !

You want to implement quickly and without complexity a management tool for your leases ? Amelkis Lease is for you.